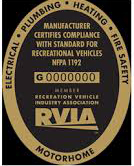

Buy a manufactured RV, and chances are that somewhere in a prominent location near the main entrance you’ll see a badge that looks much like the one at right—gold if it’s a motorhome, silver for travel trailers and fifth-wheels. Truck campers and folding campers, alas, are relegated to plain-vanilla white.

The badges, or seals, are your supposed assurance that the recreational vehicle you’ve just purchased meets certain quality and safety standards, but the truth is that they’re bought by the manufacturer even before a vehicle is built. No one has inspected your RV to determine that it complies with NFPA 1192. Such seals are aspirational statements by RV builders, self-certifying about something that may or may not be true—and as a chorus of voices has attested, that can be a hollow assurance indeed.

Put another way, the seals are little more than private-sector tax stamps, saying as little about the product to which they’re affixed as government tax stamps say about a pack of cigarettes. They’re not a legal requirement. RV manufacturers who aren’t members of RVIA—admittedly a rare breed—don’t have them. But they are a revenue generator for the Recreational Vehicle Industry Association, and as such the income they generate dwarfs all other RVIA revenue sources: of RVIA’s total 2023 revenues of $9.4 million, $5.3 million came from seal sales. Membership dues, the next highest revenue generator, brought in only $2.9 million, with the balance coming from events, sponsorships and other sources.

Here’s the problem with that: when RV production exploded in 2021, hitting more than 600,000 units, so did revenue from seal sales, hitting a record $13.4 million. And when RV sales tapered off, and then swooned, so did seal revenue, plummeting 60% over the next two years—even though spending remained largely unchanged. The bottom line is that RVIA’s total revenues last year, with seal sales still being the main income contributor, covered only 73% of the association’s $12.9 million in expenses.

Although that is a sizeable shortfall, RVIA President Craig Kirby opted not to highlight it in this past week’s annual message to members, stressing instead that he “can’t help but feel optimistic about the direction we are heading.” A financial report footnote, meanwhile, asserted that the association and its related parties “strategically planned for a material loss in 2023,” drawing on operating reserves accumulated in recent years to cover expenses. Those expenses, it’s worth noting, were reduced by only $171,285 year-over-year and were still $860,000 higher than they were two years ago.

Meanwhile, other financial storm clouds are forming. The “related parties” mentioned in the footnote include its promotional arm, GoRVing, which hasn’t covered its expenses in several years—and the hole is getting deeper. Much of GoRving’s revenues come from additional fees added by RVIA to its seal sales—a surcharge, if you will—that brought in $24.9 million in 2021, for example. Yet that same year GoRVing’s expenses outstripped revenues by $2.4 million, a gap that widened to $3.6 million in 2022 and to $9.3 million last year. All told, then, in just three years GoRVing has run up a deficit of $15.3 million, with no public explanation of how that hole is being filled.

And as with RVIA, GoRVing isn’t eager to indulge in belt-tightening: last year’s expenses of $26.9 million, while restrained in comparison with the $32.2 million expended the previous year, were just 1% lower than in 2021. Bottom line, GoRVing’s income covered only 65% of last year’s outgo, an even bigger shortfall than RVIA’s 73% deficit. How much longer can operating reserves make up the difference? RVIA isn’t saying, keeping those figures out of public view.

Kirby’s gamble, one assumes, is that RV production is going to bounce back in 2024, and with it the sale of RVIA seals and GoRVing surcharges. He could be right, although the 11.8% increase RVIA is currently projecting—to 350,000 shipments in 2024, up from 313,174 reported for 2023—is far from enough to cover the gaps. Moreover, even some of the industry’s most seasoned participants have warned that the storm clouds may persist right through the end of the year, and the current economic outlook is wobbly, at best. And as last year’s record of repeatedly downgraded production forecasts suggests, RVIA has a tendency toward overly rosy expectations.

So what’s the answer? Only the usual: raise taxes. Seals will cost more, the GoRVing surcharge will jump even more and RVIA membership dues will go up. RV buyers will pay a little more, but any question about the line charge on their invoice for an RVIA seal will be explained away as the cost of a good housekeeping assurance. And, of course, the lobbying on behalf of RV manufacturers will continue as always, funded by those gold and silver (and plain-vanilla white) stickers. That’s how the system works.